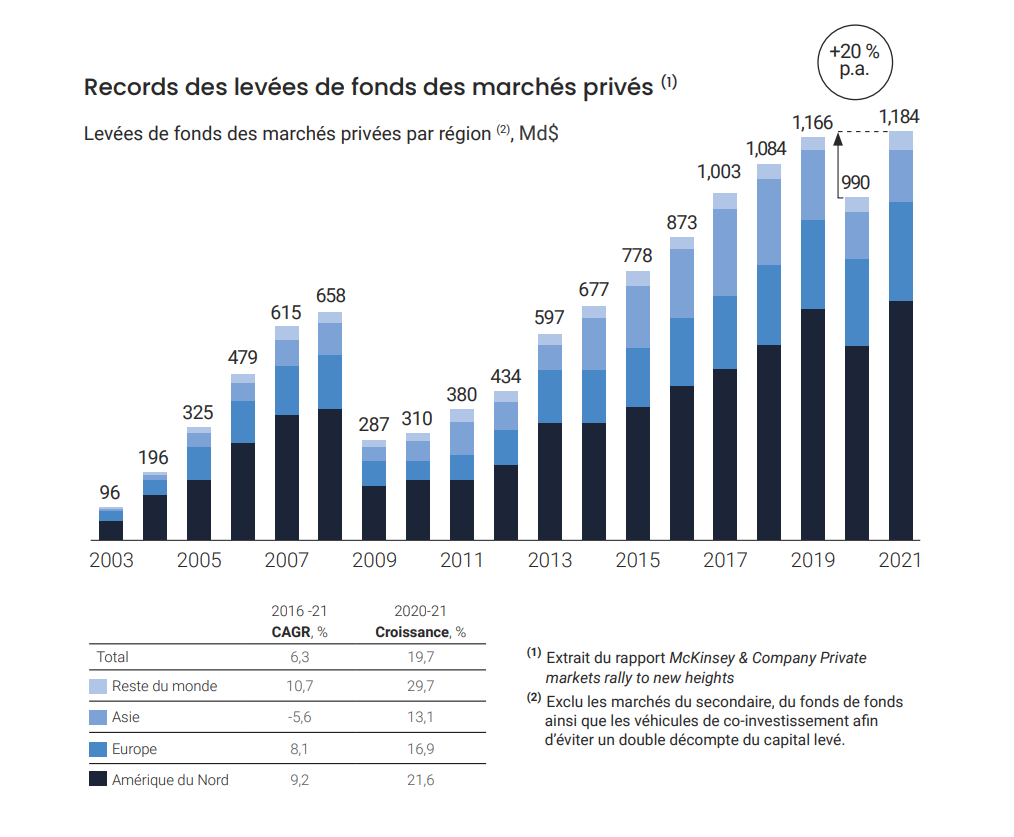

Une tendance qui concerne toutes les classes d’actifs : capital-investissement, dette privée, immobilier, fonds de couverture et ressources naturelles…

Les acteurs du marché privé ont très fortement évolué. Une entreprise moyenne dans ce secteur est désormais 60 % plus grande qu’elle ne l’était en 2016. Quant aux entreprises les plus importantes de ce secteur, elles sont plus larges qu’elles ne l’ont jamais été auparavant. Pour preuve, huit d’entre elles ont levé plus de 50 Md$ au cours de ces cinq dernières années, contre une seule en 2016.

Le Private Equity, un secteur en pleine mutation

Le marché du Private Equity se heurte à plusieurs problématiques spécifiques. En effet, la complexité opérationnelle des acteurs en place s’est accrue en raison de plusieurs facteurs tels que :

- La création de nouvelles classes d’actifs,

- L’engouement des investisseurs pour de nouvelles zones géographiques,

- La complexification des structurations de fonds et de leurs véhicules d’investissement,

- Une plus grande variété d’investisseurs,

- Une réglementation en constante évolution,

- De plus en plus d’exigence et de demandes sur mesure,

- Une prise en compte accrue des critères ESG dans les stratégies de sourcing des deals et les stratégies d’investissements.

Les besoins en matière de transformation digitale

Alors que le marché privé dans son ensemble n’en est encore qu’aux premiers stades de sa maturité numérique, les principaux acteurs investissent de plus en plus dans des solutions digitales et analytiques.

Selon McKinsey, les grands gestionnaires de fonds multi-stratégies de plus de 10 Md$ d’actifs sous gestion dépensent généralement de 1 à 5 M$ par an en solutions et logiciels tiers par classe d’actifs. En y ajoutant les dépenses liées aux capacités internes, les principaux gestionnaires, administrateurs de fonds et investisseurs institutionnels investissent des dizaines de millions de dollars par an. Cette nécessité de digitalisation s’est accrue avec le Covid-19 qui a généré de nouvelles problématiques qu’il a fallu adresser en urgence.

Il est désormais indispensable pour les acteurs de la gestion d’actifs alternatifs de bâtir une infrastructure digitale de qualité, ainsi que des processus précis afin de garantir une gestion des données efficace et sécurisée.

Les acteurs de ce marché sont de plus en plus à la recherche d’outils automatisant les tâches répétitives tels que la comptabilité, le booking et le suivi des cashflows d’investissement. Par ailleurs, l’orchestration des processus Front Office de type levée de fonds (fund raising) ou deal flow a rendu nécessaire l’utilisation des outils de type CRM permettant de gérer une base de contacts, de deals et d’investisseurs et d’accentuer la collaboration interne sur les différents dossiers.

Le renforcement des contraintes réglementaires et la hausse des exigences de la part des investisseurs ont poussé les sociétés de gestion et les asset servicers à automatiser la production de reporting et à investir dans le traitement et l’analyse des données afin de garantir leur qualité et leur disponibilité.

L’expérience client est aussi désormais la clef afin de se différencier sur un marché aussi concurrentiel. Il est nécessaire d’optimiser la qualité de service et de faciliter l’expérience utilisateur. Une des solutions qui émerge de plus en plus est la mise en place de portails investisseurs. Cela permet d’améliorer la collaboration entre les investisseurs et les gestionnaires, et le gain de temps pour ces deux parties est non négligeable et fait désormais la différence.

Selon McKinsey, les gains d’efficacité de telles initiatives sont significatifs : des économies de coûts de 4 à 7 % et des augmentations de productivité de 10 à 15 % ont été constatés.

Les solutions d’analyse peuvent fortement aider les entreprises évoluant sur le marché du Private Equity afin de maintenir leur efficacité à mesure qu’elles mutent.

Mener une stratégie de transformation digitale ambitieuse

La mise en place d’une stratégie de transformation digitale est essentielle pour aider les acteurs de l’investissement alternatif à :

- Réaliser des gains d’efficacité et d’efficience,

- Améliorer la communication interne (entre le Front, le Middle et le Back Office) et externe avec les investisseurs, les assets services, les auditeurs…,

- Disposer d’une meilleure lisibilité, qualité et fiabilité des données,

- Automatiser certaines tâches chronophages afin de passer plus de temps sur l’analyse des tâches à forte valeur ajoutée,

- Réduire les coûts opérationnels,

- Fiabiliser et accélérer la prise de décisions,

- Répondre à des demandes réglementaires de plus en plus spécifiques,

- Servir des investisseurs de plus en plus exigeants.

La digitalisation du secteur s’accompagne de nombreux défis pour les entreprises :

- Réaliser des investissements conséquents dans des solutions digitales,

- Renforcer les compétences de ses équipes avec des talents encore rares,

- Concevoir des outils personnalisés répondant à des besoins très spécifiques.

Les bénéfices se font rapidement ressentir. En effet, ces initiatives permettent de simplifier et d’optimiser les prises de décisions d’investissement. L’optimisation du traitement de la donnée et le gain d’efficacité améliorent significativement la productivité des équipes dans leur ensemble.

Conclusion

Les tendances majeures de digitalisation des acteurs du capital investissement, comme l’automatisation des processus et des reporting, la sécurité des données, la qualité des données ou encore la digitalisation de la relation investisseur, nécessitent de faire appel à des profils qualifiés qui comprennent à la fois la data et les métiers du marché privé. Il est important que les acteurs de l’investissement s’entourent des bonnes compétences afin d’élaborer et déployer rapidement une feuille de route de transformation digitale.