Solutions for automating Back Office, Middle Office and Front Office processes are a major challenge for alternative investment players. They enable simple, repetitive and time-consuming actions to be processed more quickly. Today, companies have every interest in equipping themselves with process automation solutions to reduce costs and improve the quality of their teams' work.

Players in the private equity market are lagging slightly behind in their digital transformation, especially when it comes to their own activities (booking transactions, regulatory and investor reporting, collecting data on underlying assets, orchestrating deal flow processes, etc.).

Until now, many of them worked manually with Excel spreadsheets. However, margins are now under considerable pressure, not least because of investors' growing bargaining power. Digitization would therefore enable funds to reduce their operating costs. Process automation must cover all asset management functions, i.e. Back, Middle and Front Office.

Automation of Back Office operations

In most companies, the role of the Back Office is to facilitate the work of the Front Office teams. These teams are generally made up of administrative staff. Back Office staff generally have no direct interaction with customers. Common Back Office tasks include data entry and analysis, writing, research, claims processing, accounting, human resources and IT support.

The Back Office therefore generally processes requests manually on Excel or via several applications which they have to correlate. The main problem is therisk of operational error, which remains high. Generally speaking, Excel-based accounting closings follow a long and tedious process, involving numerous manual restatements which can slow down the production of accounting reports (balance sheets, income statements) and financial reports (CAS).

The implementation of a governance system makes it possible to set up a chain of control between the various players, such as investors, funds and acquired companies. Governance focuses on analyzing the control relationships between the various stakeholders through the regulations in force. With the increase in KYC (Know Your Customer) checks and procedures for companies, industry players need to collect and verify information on the identity and integrity of investors.

Against this backdrop, every company needs to put in place appropriate corporate governance structures to promote sustainable value creation. In particular, this is the best way to guarantee risk management and reduce fraud and corruption.

What can we expect from the automation of back office operations?

- Process automation not only facilitates the monitoring of securities and cash flows, but also enables extractions to be produced rapidly, reducing the risk of error. Teams can thus concentrate on more strategic, high value-added tasks.

- The implementation of automation solutions enables us toachieve greater scalability by managing more funds, investors and flows.

- Automated processes enable better consolidation of data, so that managers can make rapid decisions on the basis of reliable, up-to-date data.

- From an accounting point of view, it is strategic to centralize information in a single database, and to implement a robust accounting interpreter toautomate accounting entries.

- The importance of structured data governance is a major issue for organizations. It creates a climate of trust that attracts investors and leads to new investments.

- Automated compliance checks pre-trade and post-trade processes to ensure that the fund's investment strategy is being followed, and that regulatory constraints are being respected.

Automation of middle office operations

Located between the Front and Back Offices, the Middle Office is the intermediary between these two departments. It must be responsive and efficient in order to control Back Office data while supporting the Front Office.

The Middle Office helps to ensure that transactions affecting the assets and liabilities of investment vehicles are carried out correctly, and contributes to thepreparation of periodic accounting and financial statements for investment vehicles. In addition, the Middle Office produces performance reports and ad-hoc analyses for managers, enabling them to monitor and steer portfolio companies.

Depending on the type of investment structure, and particularly those using the "private debt" asset class, performing and monitoring calculations such as cash interest and PIK are complex and time-consuming tasks.

Our convictions on the digitalization of the Middle Office.

- Digitization is having just as much of an impact on the middle office activities of private equity players. The rapid availability and format of data is a major challenge.

- Simplifying processes improves information flow and data quality.

- Digitization initiatives need to be carried out gradually, with change management in place to ensure employee buy-in.

- Each line in the portfolio must be analyzed and monitored. The Middle Office must generate performance indicators for the portfolio managers, so that they can optimize the management of the underlying companies. It is therefore important to model, simplify and automate the calculation of the various KPIs.

Automation of Front Office operations

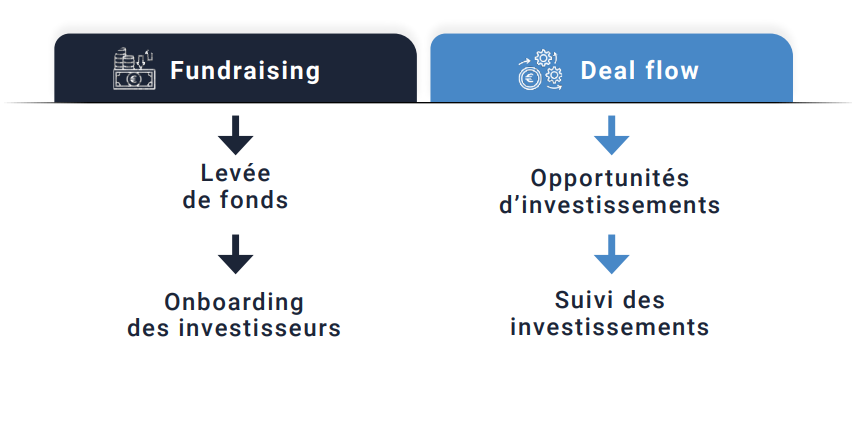

The Front Office is the management company's interface with investors on the one hand, and portfolio companies on the other. In other words, Front Office staff interact directly with investors and company boards throughout the investment cycle (Fund raising - Deal flow - Investment - Asset Management - Exit).

Depending on the organization of each management company, the main functions of this department are: fundraising, investor research and onboarding, identifying and analyzing investment opportunities, and monitoring and managing investments.

Investment decisions must be made quickly and rationally.

The benefits of automating the operations involved in front-office functions.

Front office process automation helps management companies to :

- Free up time for Front Office teams to focus on fundraising, deal sourcing and analysis, and investment portfolio diversification.

- Improve and streamline internal communication during due diligence processes, as well as external communication with investors.

- Obtain real-time analyses to better manage investment funds.

Conclusion

Task automation is becoming a major issue in most companies today. Today, every company needs to automate processes in order to save time and reduce production costs. Alternative investment players need to be aware of the many opportunities offered by data, so that they can then select the most relevant and prepare for their implementation through a roadmap of data use cases.